“So, who are your competitors?” Within the start-up ecosystem, this hyper trivial question is asking for a routine answer. It is one of those questions that usually does not raise any serious worry among start-ups asking for money. But it should. Because these standard responses follow a pattern which can be easily anticipated and usually is astoundingly poor. Variant 1: … Read More

Die Illusion des Know-How

Letzte Woche habe ich mich in einem Post einigermaßen unfreundlich über ein sogenanntes Whitepaper von @RolandBerger und @sas-dach geäußert. Es trägt den stolzen Titel „Die Illusion der Kundenzentrierung, 5 unbequeme Thesen zum digitalen Marketing“. Schimpfen ist immer leicht. Daher möchte ich an dieser Stelle die Gründe für meine Kritik nachholen. Mit ihr sollte nicht gesagt sein, die deutsche Wirtschaft benötige … Read More

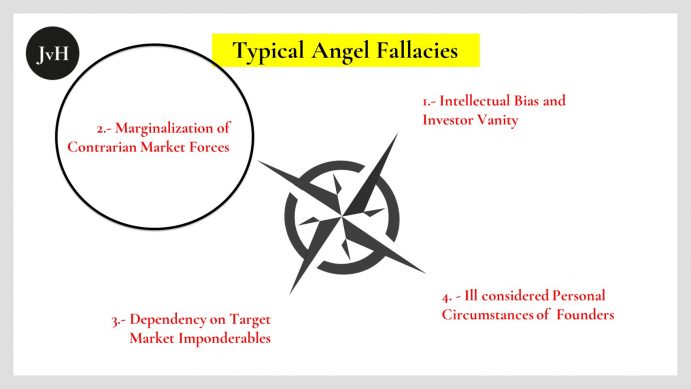

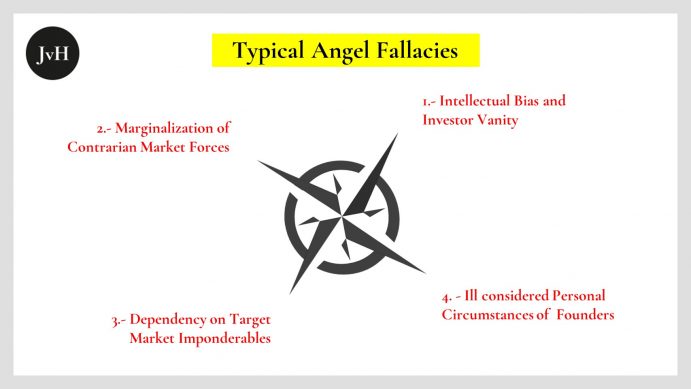

Confirmation Bias and Neglect of Contrarian Market Forces

Start-ups need a USP for their products and services that is not just unique but also in demand. There lies a structural tension in this: Whatever is really novel or unique cannot be in demand, because nobody as yet knows about it. So, frequently you can only guess or assume or hope that the new feature of a new product … Read More

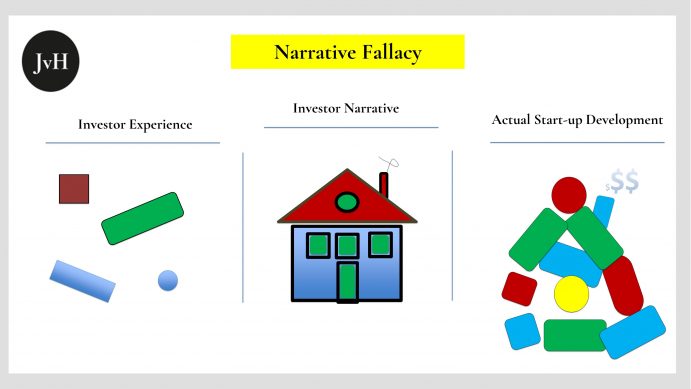

Angel Bias and Angel Vanity

Investors and serial entrepreneurs usually entertain some good and many not so good investment memories respectively. Angel investors, who usually previously either worked as VCs or (serial) entrepreneurs therefore tend to be biased towards certain investment targets, certain technologies, certain types of business model etc. Their previous roles as investors (fund managers) or (serial) entrepreneurs make angels believe they have … Read More

Guy Spier’s Personal Investment Checklist as Master for Venture Investments

Earlier this year my friend Alexander Groß introduced me to Guy Spear’s autobiographic vade mecum on value investing: The Education of a Value Investor, My Transformative Quest for Wealth, Wisdom and Enlightenment, NY, 2014. I feel most indebted to Alexander for the simple reason that this is a wonderful book written by a wonderfully modest, humorous, genuine and yet most … Read More

Management Gurus on “Digital” and “Social” Science Fiction is Fiction, Not Science

Individuals, who seemingly buck the trend and give themselves the air of unconventional, “brave” and, of course, politically incorrect opinionizing are a fairly common phenomenon: Officially, civic, political and business worlds alike are very liberal with praise for those kicking against the pricks, while, in reality, they endeavour to maximise homogenous mass behaviour and conformity. It is a phenomenon characteristic … Read More

Rich Man’s Lottery (Part II) The Mystery of the Blind Hunt for Maximum Risk

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported last week among other sources by the NY Times. So, is he right? In Venture … Read More

“Rich Man’s Lottery”? VERDAD CEO Rasmussen questions VC Business Model – Is he right?

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported this week among other sources by the NY Times. The newsletter report The Lure … Read More

“The Only Thing that Matters for a Start-Up”? Product Market Fit or: When Truisms and Misnomers Replace Judgement

Like everybody else in the venture scene, I do admire Marc Andreessen for his remarkable achievements in both the tech and venture territories. Yet, admiration is no adulation. If justified, criticism might pay a better tribute to the man than endless quotations of some of his more questionable thoughts. On October 12, 2009 Marc posted a, now famous, article to … Read More

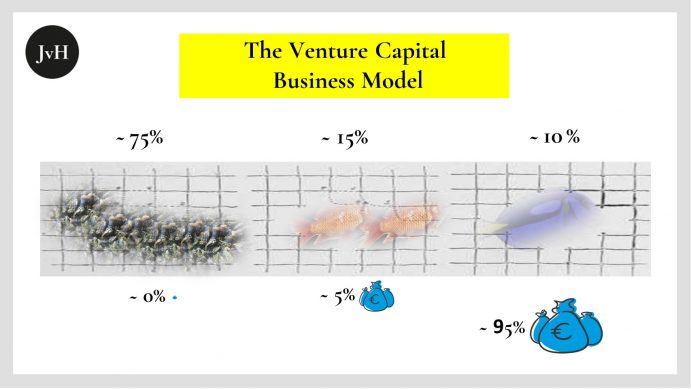

The VC Business Model: Pareto Driven to Extremes

Virtually all venture capitalists agree that only a very tiny fraction of their targets accounts for the positive overall return of their funds, while most investments produce either no significant contribution or even result in complete losses, thus producing negative effects on fund returns. Depending on the individual fund, alternative target industries, investment stages, regional priorities, etc. the statistics vary, … Read More