Part 1: “Diversification” From time to time people ask me whether investing selectively in start-ups as a “profession” is not quite an irresponsible gamble, especially if, like in my case, you have practically no other current sources of income. This question is meant rhetorically, because the people who ask and I, we know Kind Advisors Such rhetoric is usually followed … Read More

Was VCs und Business Angels verbindet – und was sie unterscheidet

Teil 1: „Diversifikation“ Hin und wieder werde ich gefragt, ob denn das selektive Investieren in Startups als „Beruf“, nicht ein unverantwortlich riskantes Vergnügen darstelle, insbesondere dann, wenn man, wie ich, über praktisch keine anderen laufenden Verdienstquellen verfüge. Dies ist eine rhetorische Frage, denn die Fragenden und der Befragte wissen beide a) dass dieses Risiko tatsächlich ziemlich hoch ist und b) … Read More

Ludwig Wittgenstein on Business Process Management

Those familiar with the Anglo-Austrian philosopher Ludwig Wittgenstein know that one usually distinguishes two Wittgensteins: The earlier one who wrote the “Tractatus Logico-Philosophicus” (1921) and the later one who is best known for his “Philosophical Investigations” (1953). Both oeuvres contradict each other. The later Wittgenstein distanced himself from the earlier one. Put in a nutshell (grossly oversimplifying and distorting his … Read More

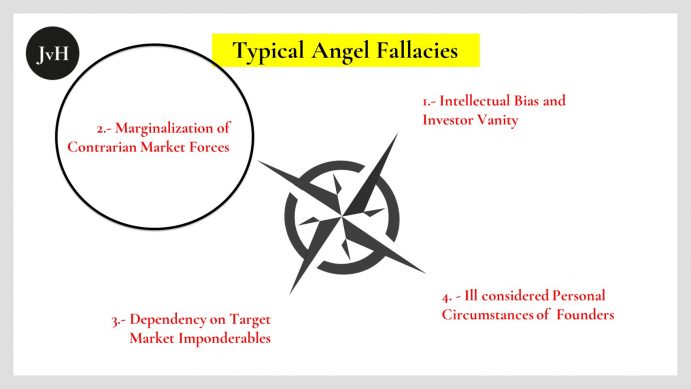

Angel Fallacies 3.1: Neglect of Target Market Imponderables (“Competitors”)

“So, who are your competitors?” Within the start-up ecosystem, this hyper trivial question is asking for a routine answer. It is one of those questions that usually does not raise any serious worry among start-ups asking for money. But it should. Because these standard responses follow a pattern which can be easily anticipated and usually is astoundingly poor. Variant 1: … Read More

Confirmation Bias and Neglect of Contrarian Market Forces

Start-ups need a USP for their products and services that is not just unique but also in demand. There lies a structural tension in this: Whatever is really novel or unique cannot be in demand, because nobody as yet knows about it. So, frequently you can only guess or assume or hope that the new feature of a new product … Read More

Angel Bias and Angel Vanity

Investors and serial entrepreneurs usually entertain some good and many not so good investment memories respectively. Angel investors, who usually previously either worked as VCs or (serial) entrepreneurs therefore tend to be biased towards certain investment targets, certain technologies, certain types of business model etc. Their previous roles as investors (fund managers) or (serial) entrepreneurs make angels believe they have … Read More

“The Only Thing that Matters for a Start-Up”? Product Market Fit or: When Truisms and Misnomers Replace Judgement

Like everybody else in the venture scene, I do admire Marc Andreessen for his remarkable achievements in both the tech and venture territories. Yet, admiration is no adulation. If justified, criticism might pay a better tribute to the man than endless quotations of some of his more questionable thoughts. On October 12, 2009 Marc posted a, now famous, article to … Read More

In B2B its’s 2D, not 3D, Dude! Check Lindera!

Considering my modest financial means, I am actually quite heavily invested in 3D and VR. However, I must admit that now and then I ask myself: Where does all this craze about 3D and VR come from? Our “real” world is already 3D, is it not? And frankly: I do prefer a real reality to a virtual one. True, it’s … Read More

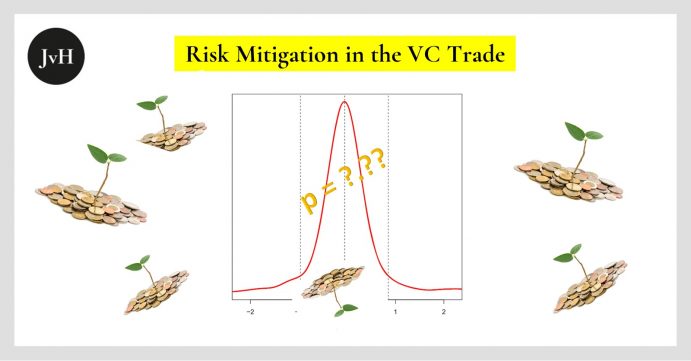

Risk Mitigation in the Venture Trade (Part 1)

Like in conventional asset management theory, the credo for the need of a “distribution of risk” or “risk diversification” is generally also considered to be inviolable in the venture business. In my opinion, the imperative is fairly nonsensical – at least when it is based on the number or the type of targets to be chosen. Within the asset class … Read More

On Quality and Quantity in Start-up Processes

The issue how to quantify quality is an old one. In antediluvian times it used to be a common place that you cannot e.g. map quality on straight lines, because quality is a multi-dimensional category whereas quantity is one-dimensional. In business such philosophical qualms are generally perceived as academic and irrelevant: In HR and marketing for instance, where the “quality” … Read More