Teil 1: „Diversifikation“ Hin und wieder werde ich gefragt, ob denn das selektive Investieren in Startups als „Beruf“, nicht ein unverantwortlich riskantes Vergnügen darstelle, insbesondere dann, wenn man, wie ich, über praktisch keine anderen laufenden Verdienstquellen verfüge. Dies ist eine rhetorische Frage, denn die Fragenden und der Befragte wissen beide a) dass dieses Risiko tatsächlich ziemlich hoch ist und b) … Read More

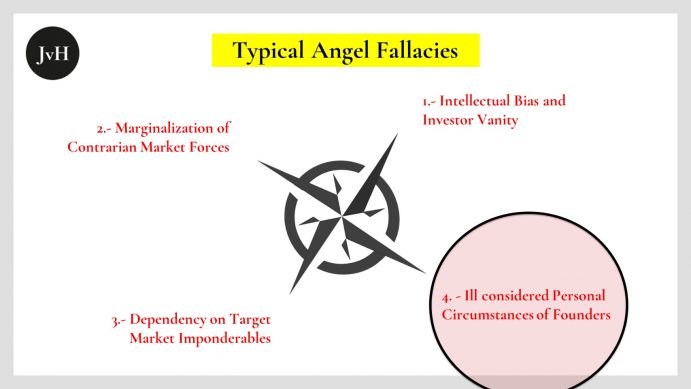

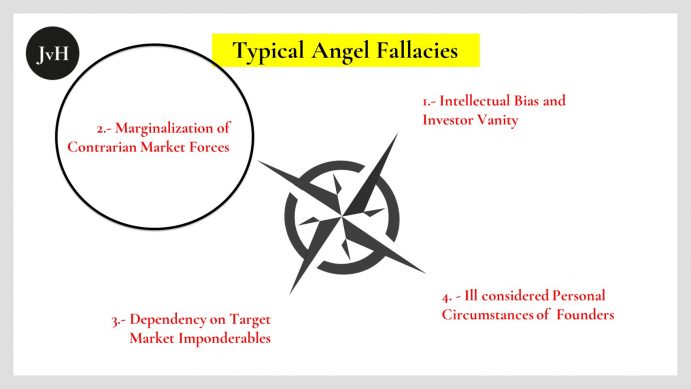

Angel Fallacies 4: Neglect of Founders’ Personal Circumstances

The personal circumstances of employees are a minefield for employers: Whether in hiring or in staff development: On the one hand, as an employer, you have to consider potential risks such as illness, financial stability, family situations, even possible pregnancies; on the other hand, in an ideal world, these issues should really remain a private matter for the respective employee … Read More

Angel Fallacies 3.1: Neglect of Target Market Imponderables (“Competitors”)

“So, who are your competitors?” Within the start-up ecosystem, this hyper trivial question is asking for a routine answer. It is one of those questions that usually does not raise any serious worry among start-ups asking for money. But it should. Because these standard responses follow a pattern which can be easily anticipated and usually is astoundingly poor. Variant 1: … Read More

Confirmation Bias and Neglect of Contrarian Market Forces

Start-ups need a USP for their products and services that is not just unique but also in demand. There lies a structural tension in this: Whatever is really novel or unique cannot be in demand, because nobody as yet knows about it. So, frequently you can only guess or assume or hope that the new feature of a new product … Read More

Angel Bias and Angel Vanity

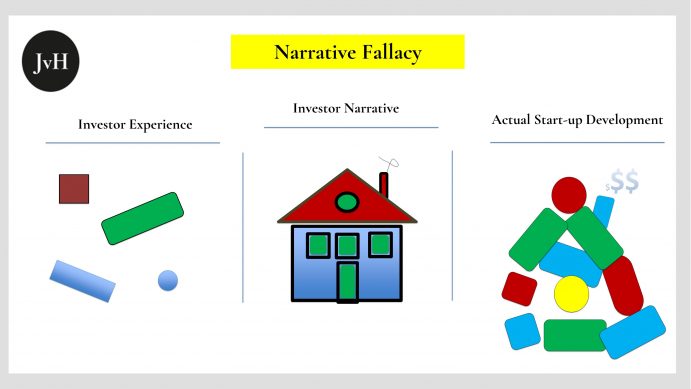

Investors and serial entrepreneurs usually entertain some good and many not so good investment memories respectively. Angel investors, who usually previously either worked as VCs or (serial) entrepreneurs therefore tend to be biased towards certain investment targets, certain technologies, certain types of business model etc. Their previous roles as investors (fund managers) or (serial) entrepreneurs make angels believe they have … Read More

Rich Man’s Lottery (Part II) The Mystery of the Blind Hunt for Maximum Risk

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported last week among other sources by the NY Times. So, is he right? In Venture … Read More

“Rich Man’s Lottery”? VERDAD CEO Rasmussen questions VC Business Model – Is he right?

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported this week among other sources by the NY Times. The newsletter report The Lure … Read More

- Page 2 of 2

- 1

- 2