There are times when you really wonder…

Four days ago, I read an article on hackernoon.com on “The Value of a Brand for Tech Companies”

by Cameron McLain, principal at Hummingbird Ventures. The gist of this article is that tech start-ups and VCs alike should embrace the idea, that brands constitute an important value for tech start-ups worth of being developed, welcomed, and paid for by venture firms.

The author is fully aware of the fact that VCs find tech founders who refer to their “brand” as a “moat” against copycats curious, to say the least. But he thinks this attitude is prejudiced and wrong. So, what is wrong with Cameron’s statement? Well, virtually everything. He mentions “three main reasons why brands are becoming an increasingly important component of high-growth technology businesses”:

1. “The role of brands in society is evolving. […] Trusted brands act as an effective heuristic for parsing through noise [of information overload].”

2. “The strength of technological moats has weakened due to the accelerated speed of innovation and the availability of capital.”

3. “The greatest challenge for a startup today […] is to foster awareness. Awareness and a loyal fan base aka brand, is invaluable.”

First of all: Start-ups do not own “trusted” brands because they are start-ups, i.e. new kids on the block. So, the whole article is basically an article about nothing, a phantom.

Secondly, brands are based on much, much more than PR, social media and advertising. Their principal property is customer trust. This is what makes brands valuable from an accountant’s point of view. Smart VCs will not and cannot invest in trusted brands. The price would be too high, the potential too low.

Thirdly: Tech innovation is the only field where a start-up can be successful in competing with incumbent brands/firms on the one hand and new competitors or copycats on the other.

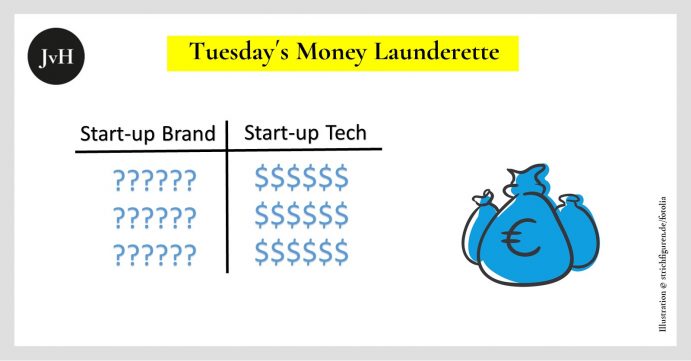

As a matter of fact, I know a number of so-called tech start-ups that inflate their balance sheets with intangible assets like brands, because they do not possess anything else. That’s their way of prolonging their death agony. Chartered Accountants see them as what they are: Smoke blown into the eyes of short-sighted investors.

Cameron refers to Elon Musk’s Tesla and says Musk underestimates the value of brands: “Musk opined that moats are >lame< and companies should stay competitive through innovation. In this case, I think Musk is underestimating the moat that his personal brand has contributed to his companies.”

Well, everybody knows that Musk so far has not created any moat whatsoever with Tesla. There still is little trust, no sustainable production and there are casualties. True, Tesla is a brand. It’s a brand on the stock market that owes a lot to i) tech and ii) that other “umbrella brand”: Musk himself. Besides, Tesla by now is no longer a start-up and can therefore begin to harvest the huge investment he and his shareholders put into Tesla’s technologies.

Cameron argues “the theory of a long tail of winners” has not “manifested”. Well, the opposite is true. Social media celebrity hype is no case to prove the “long tale theory” wrong. Cameron muses “Kylie Jenner did $1B in sales for her makeup line last year”. Make-up is tech??? Real tech company Snapchat lost more than 1.3 B market capitalisation because Kylie Jenner said she won’t use it anymore. This is the problem with phony pseudo branding, aka as the temporary production of “awareness”. No moats can prevent the collapse of a tech brand, unless there is some fundamental tech to save it, which, of course, there was in the case of Snapchat.

Cameron also mentions the high valuation of WeWork. Again, one may wonder: WeWork – a tech entity???

Yes Cameron, we do “live in a blockbuster world”. (By the way: That is not new. The 70s of the last century were very much enamoured with the production of a veritable and also much critizised celebrity hype. Read Tim Wu’s “The Attention Merchants” (Chapter 17: Establishment of the Celebrity-Industrial Complex). But Revolut and Robinhood are fintech companies which received high valuations because of their high tech and not because of millions of customers trusting their nascent brands. And Google, Apple, Facebook and amazon engage in acquihires because of the tech and the brains only. A pretty good brand they already got themselves…