Auch wenn Founders, Angels und VCs es eigentlich besser wissen (müssten): Immer noch betrachten allesamt Business Angels schlicht als Micro-VCs. Ein Kardinalfehler, denn private VCs interessiert die Fonds-Rendite, Angels jedes einzelne Startup (und dessen Renditepotenzial).

Der „professionelle“ Angel: Ein Oxymoron

In meinem vorletzten Post hatte ich mich mit der Frage auseinandergesetzt, wie gut oder schlecht begründet die von immer mehr erfahrenen Business Angels geteilte Auffassung ist, wirtschaftlichen Erfolg könnten Angels, schierem Glück geschuldete Ausnahmen ausgenommen, nur haben, soweit sie, wie VCs, über ein „hinreichend“ großes Beteiligungsportfolio verfügen. Nur wenig verkürzt lässt sich diese Position als Rat an die Kollegen verstehen, … Read More

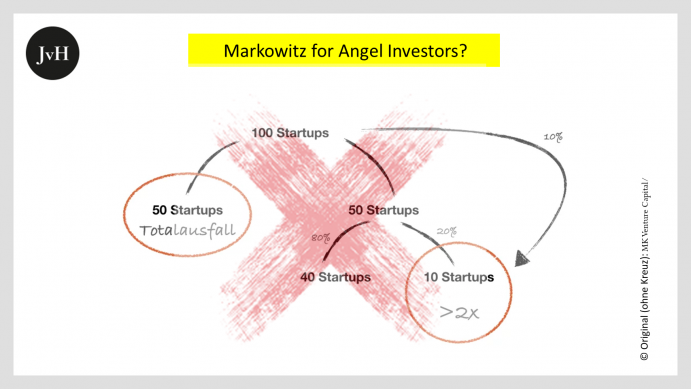

Portfolio-Theorie für Business Angels?

Es ist unsinnig, Business Angels ein Vorgehen zu empfehlen, das einerseits am geringen Erfolg durchschnittlich oder typisch (median) erfolgreicher/-loser Angel Investments und andererseits am in der Regel größeren Erfolg großer VC- oder Super Angel-Portfolios Maß nimmt.

Wer einem solchen Rat folgt, sollte wissen, dass er sich bestenfalls an erfolgreichen LPs (Limited Partners), also nicht an Business Angels und schon gar nicht an erfolgreichen Business Angels orientiert, für die es keine konkreten Qualitätsmerkmale geben kann.

Blindes Vertrauen

Jedes Einzelinvestment als Business Angel in ein frühphasiges Startup ist ein Investment in ein unbeschriebenes Blatt. Ich kann als Angel also gar kein Profi-Investor sein. Denn Profis kennen ihr Metier. Takeaways: Wenn Du gemeinsam mit Angels investierst, die über eine tiefe fachliche Expertise verfügen, lass’ Dich erstens nicht von deren betriebsblinden Optimismus blenden und vertraue zweitens bei DDs nicht dem Risikokalkül von VCs.

Market need: yes, Scalability: no CVCs als Steigbügelhalter für schwer skalierbare AI eine gute Option

CVCs könnten für weniger gut skalkierende KI-Anwendungen zum Steigbügelhalter werden.

Die genormte Sprache

In meinem letzten Post schrieb ich darüber, wie leicht sich die Venture Capital dominierte StartUp-Blase von der öffentlichen Meinung beeinflussen lässt. Ich hatte dies am Beispiel der zweiten, ChatGPT-induzierten Begeisterungswelle der VCs für die Themen und Geschäftsmodelle von KI-StartUps deutlich gemacht. Über „öffentliche Meinung“ und „veröffentlichte Meinung“ ist viel geschrieben worden. Das Thema ist heikel. Doch meine Frage hat keinen … Read More

„VCs sind auch nur Menschen“

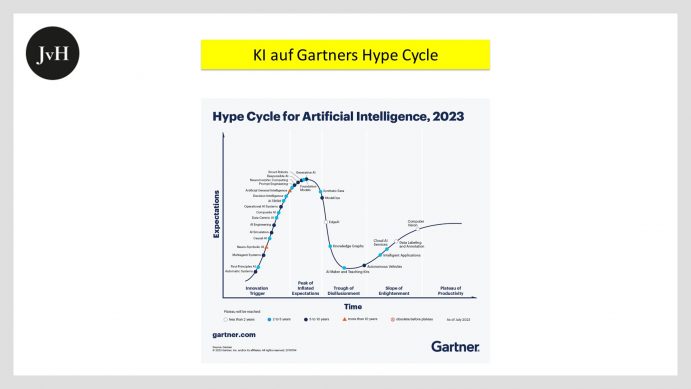

KI, Gartner Hype Cycle und die Beeinflussbarkeit (vieler) deutscher VCs Im Herbst des zurückliegenden Jahres 2022 nahm ich auf der Suche nach Bridge-Finanzierungen für meine KI-Beteiligungen nicht bei allen, doch gerade bei sehr namhaften deutschen VCs, folgendes General-Sentiment bezüglich ihres Interesses an KI-Investments wahr: 1. Algorithmen skalieren zu oft zu schlecht. Wir fahren unser KI-Engagement deutlich zurück. 2. Ohne nachgewiesenen … Read More

Schuldig!

Schuldig Wer schon einmal ein StartUp in den regulierten Markt einer Wertpapierbörse gebracht hat, mindestens der oder die weiß, dass ein moralinsaures sich Erheben über ‚fake it till you make it‘ – Missetaten anderer unweigerlich pharisäerhaft wirken muss. Mit blütendweißer Weste kommt man im StartUp – Ökosystem nicht weit, neu an der Börse schon gar nicht – leider. Nur wenige … Read More

Product Market Fit: 25 triviale Argumente, warum PMF sinnbefreit ist

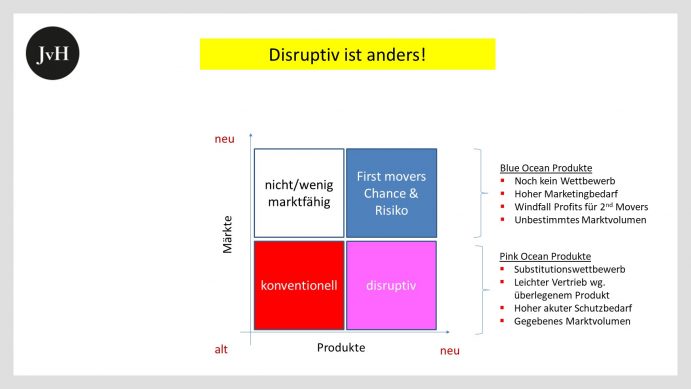

“The biggest needle movers will be things that customers don’t know to ask for. We must invent on their behalf. We must tap into our own inner imagination about what’s possible.”Jeff Bezos Definition: Produkte (Dienstleistungen werden nachfolgend immer mitgedacht) sind materielle und immaterielle oder teilweise materielle und teilweise immaterielle Träger von Eigenschaften, mit denen Bedürfnisse von Menschen und Organisationen mittelbar … Read More

Künstliche Fonds-Intelligenz KI als Vehikel der VC-Portfoliobestückung

Wenige Themen werden bei VC-Investoren und Business Angels derzeit so heiß verzehrt wie die Künstliche Intelligenz. Es finden sich in dem mit Anglizismen und Akronymen nicht gerade schlecht bestückten Gründervokabel-Universum keine, die es mit solchen aus dem Umfeld der Künstlichen Intelligenz stammenden in Punkto Popularität aufnehmen könnte. Offensichtlich handelt es sich bei AI, ML, DL um die entscheidenden Nukleotide des … Read More