Founders Seeking Corporate Exits should not Waste their Cash on Sales & Marketing

In 2011 the Startup Genome Project defined four types of internet start-up: The automizer, the social transformer, the integrator and the challenger. These types do have their value but somehow, they do not respond to my needs as an investor.

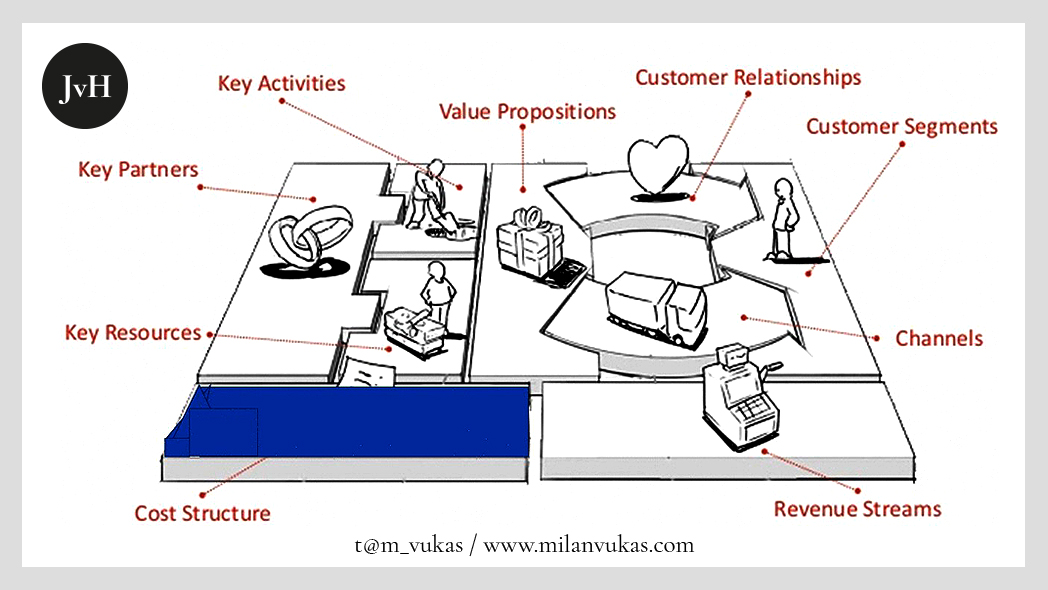

One of several other keys which don’t really fit into the Genome categories is the cost structure of target entities. As a seed investor I want to minimize my risk and thus see to it that my money won’t be wasted. The cost structure of a target entity can serve as a helpful indicator. I distinguish between two types of tech start-ups:

Start-ups belonging to type 1 focus on developing stand-alone technologies for which there is a corporate market, i.e. potential corporate buyers of the technology who would benefit from it.

Start-ups belonging to type 2 focus on developing their own markets. Those may be contested red ocean markets or uncontested blue ocean markets. Be this as it may: They are their markets.

In my humble belief, the need to distinguish between type 1 and 2 is an obvious one. Unfortunately, though, I speak far too often to founders who present me with business plans with complex and expensive sales and marketing strategies. When I ask them, what is purpose of all that money spent they tell me: “Why, obviously to become the market leader!” When I ask them how they plan to exit they say: “We will sell ourselves to Facebook/amazon/eBay/Microsoft….” This simply does not make sense.

Roughly speaking exit strategies for type 1 targets take the shape of an asset deal because the buyer is – for whatever reason – interested in the technology and their developers. Maybe the buyer wants to obtain exclusive use rights, maybe she wants to get rid of a potentially dangerous competitor, maybe she wants to sell to the test markets of the target, maybe she just wants to hire good people and is prepared to pay a symbolic premium to satisfy the founders’ ego, i.e. exercise an acquihire, as they call it in the Valley. In legal terms such an asset deal might thus take the shape of a share deal – strategically speaking it remains an asset deal.

The buyer DOES NOT want to spend her money on an asset, on which founders wasted most of their previously obtained cash in an effort to conquer clients. That would be money burnt. No added value for the corporate buyer. To put it in a nutshell: There is no need for scaling in type 1. What founders should have done instead of scaling is testing potential markets. After all: the final success of their product, after they exited, will depend on that.

Tech start-ups belonging to type 2 need to focus on BOTH their technology AND their markets. Here the technology is a means to an end – the end to become the lone or at least biggest player in the respective segments. It is clear that type 2 companies – usually they are some kind of platform – require far more investment than type 1 companies because they do need to scale, market and sell.

Just like type 1 targets, typical type 2 targets may be engaged in b2b and/or b2c markets. But here it is their markets. So, they do have to think very hard on how to address these markets given that cash is very limited and it is by no means easy to gain dominance in tech markets by word-of-mouth or media earned (but not paid).

#startup genome #start-up investors #seed investments #types of start-up #scaling #start-up #cost structure #corporate exit #sales #marketing #teccap.de #startup-partner.de