Start-ups need a USP for their products and services that is not just unique but also in demand. There lies a structural tension in this: Whatever is really novel or unique cannot be in demand, because nobody as yet knows about it. So, frequently you can only guess or assume or hope that the new feature of a new product … Read More

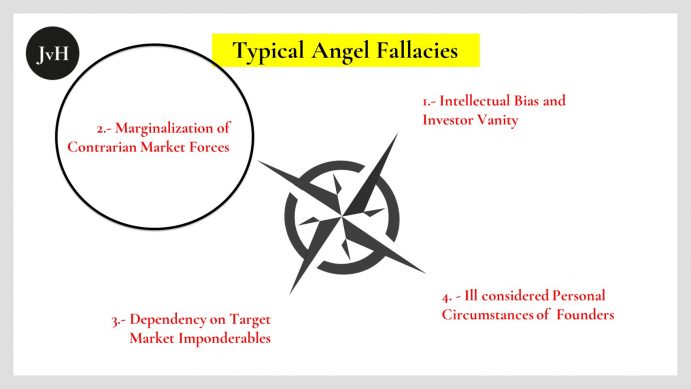

Angel Bias and Angel Vanity

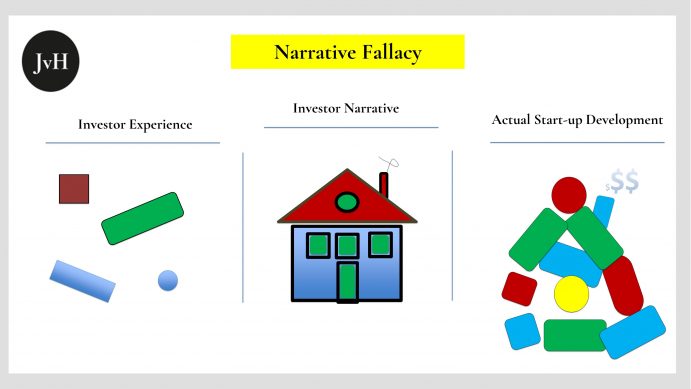

Investors and serial entrepreneurs usually entertain some good and many not so good investment memories respectively. Angel investors, who usually previously either worked as VCs or (serial) entrepreneurs therefore tend to be biased towards certain investment targets, certain technologies, certain types of business model etc. Their previous roles as investors (fund managers) or (serial) entrepreneurs make angels believe they have … Read More

Rich Man’s Lottery (Part II) The Mystery of the Blind Hunt for Maximum Risk

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported last week among other sources by the NY Times. So, is he right? In Venture … Read More