“So, who are your competitors?” Within the start-up ecosystem, this hyper trivial question is asking for a routine answer. It is one of those questions that usually does not raise any serious worry among start-ups asking for money. But it should. Because these standard responses follow a pattern which can be easily anticipated and usually is astoundingly poor. Variant 1: … Read More

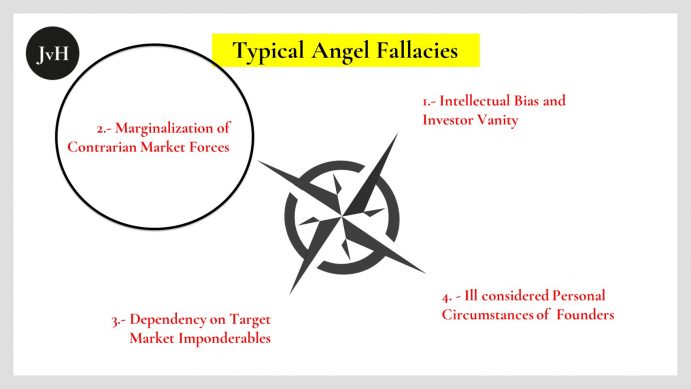

Confirmation Bias and Neglect of Contrarian Market Forces

Start-ups need a USP for their products and services that is not just unique but also in demand. There lies a structural tension in this: Whatever is really novel or unique cannot be in demand, because nobody as yet knows about it. So, frequently you can only guess or assume or hope that the new feature of a new product … Read More

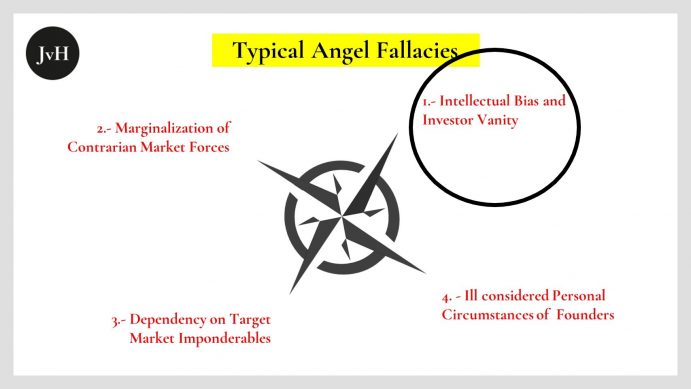

Angel Bias and Angel Vanity

Investors and serial entrepreneurs usually entertain some good and many not so good investment memories respectively. Angel investors, who usually previously either worked as VCs or (serial) entrepreneurs therefore tend to be biased towards certain investment targets, certain technologies, certain types of business model etc. Their previous roles as investors (fund managers) or (serial) entrepreneurs make angels believe they have … Read More

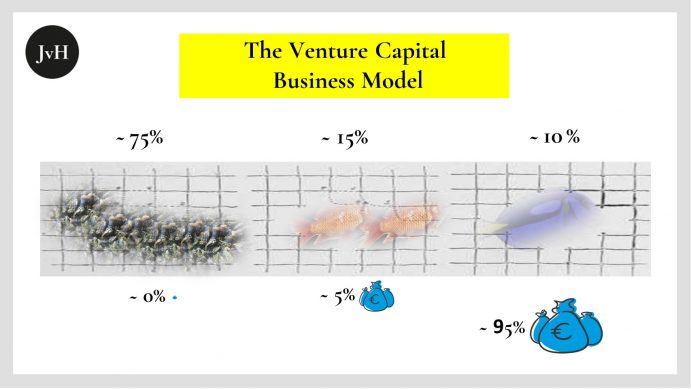

The VC Business Model: Pareto Driven to Extremes

Virtually all venture capitalists agree that only a very tiny fraction of their targets accounts for the positive overall return of their funds, while most investments produce either no significant contribution or even result in complete losses, thus producing negative effects on fund returns. Depending on the individual fund, alternative target industries, investment stages, regional priorities, etc. the statistics vary, … Read More

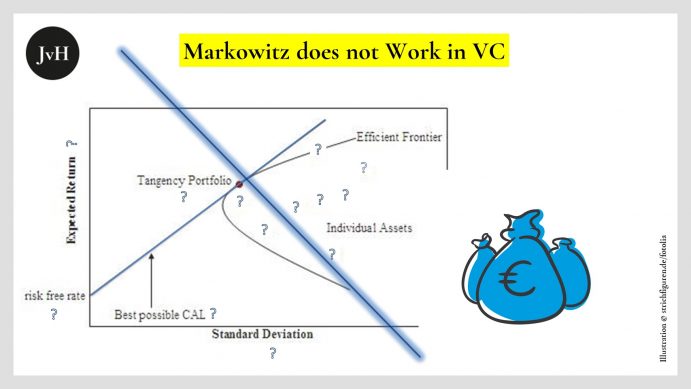

Risk Mitigation in the Venture Trade (Part 3): Markowitz does not Work

I guess (in the course of my two most recent blogs) I have made my basic stance clear that standard portfolio theory fails as far as start-up portfolios are concerned. Let us, just for the sake of the argument 😉, assume Markowitz’s paradigm could somehow be applied, or rather, transferred onto the start-up stage. What would it look like? I … Read More

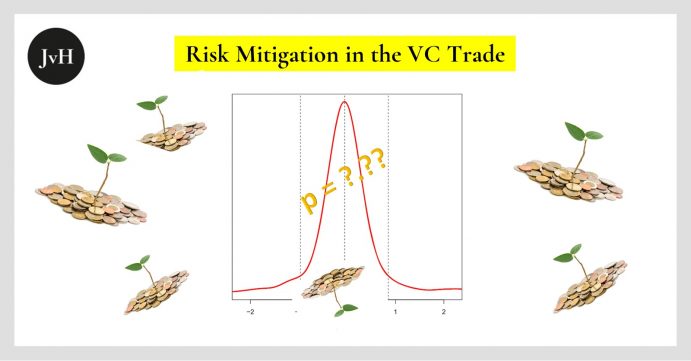

Risk Mitigation in the Venture Trade (Part 1)

Like in conventional asset management theory, the credo for the need of a “distribution of risk” or “risk diversification” is generally also considered to be inviolable in the venture business. In my opinion, the imperative is fairly nonsensical – at least when it is based on the number or the type of targets to be chosen. Within the asset class … Read More

Smart Tech VCs do not Invest in Brands

There are times when you really wonder… Four days ago, I read an article on hackernoon.com on “The Value of a Brand for Tech Companies” by Cameron McLain, principal at Hummingbird Ventures. The gist of this article is that tech start-ups and VCs alike should embrace the idea, that brands constitute an important value for tech start-ups worth of being … Read More