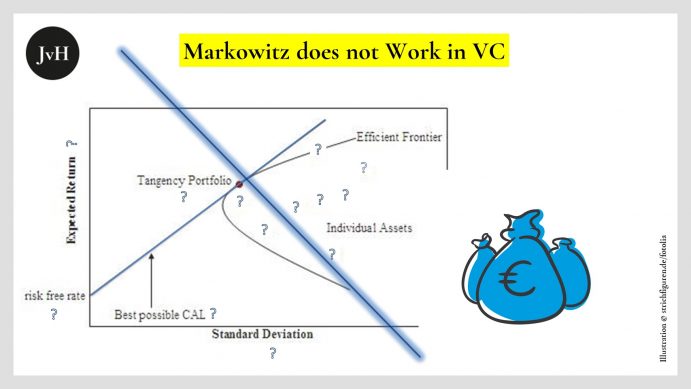

I guess (in the course of my two most recent blogs) I have made my basic stance clear that standard portfolio theory fails as far as start-up portfolios are concerned. Let us, just for the sake of the argument 😉, assume Markowitz’s paradigm could somehow be applied, or rather, transferred onto the start-up stage. What would it look like? I assume it would look like this:

- Step 1: Define targeted fund return (IRR) after n years, cash to be returned to LPs, and fees and carry to be distributed among partners and employees.

- Step 2: Analyse historic performance of all available start-up “asset types/ sectors/ capitalization stages”.

- Step 3: Deploy efficient investment strategy which, given your targeted return and available types of start-ups, reduces risks to a minimum by negatively correlating the chosen target sectors.

The Achilles heel of this model is step 2: Within innovative tech spaces like bio-technology, bio-chemistry, internet technology, AI, data storage and harvesting, etc. where life-cycles frequently run much shorter than a decade, there simply are no histories let alone stable sectors and types of technologies to be analysed. Hence, there are no negative correlatives to be linked in an attempt to minimise risks.

If you cannot categorise start-ups as complying to risk categories x, y or z in any way – neither by looking at their market segments nor by looking at their capitalization or stage, then any such assessment or typecast in an attempt to attribute a specific risk is subjective and arbitrary, in short, reckless and invalid.

This brings us back to square 1: So far, in the course of my last two blogs and this one, we’ve seen what all does not work in terms of risk mitigation for start-up portfolios:

- Choosing a sufficiently high (or low) number of target entities is a hopeless attempt to minimise portfolio risks. (This was discussed in my blog previous to last week’s.)

- Looking at internal risk factors (team structure, processes, type of product or service etc.) might provide valuable clues as to potential risks but is by no means sufficient, because potential such risks cannot be quantified or appropriately assessed in connection with target performances of portfolios. (This was discussed last week.)

- Negatively correlating target branches and/ or target entity investment stages is pointless, as we recapitulated today.

So, only one small question remains unanswered: What does work? I shall try to provide an answer to this next week.