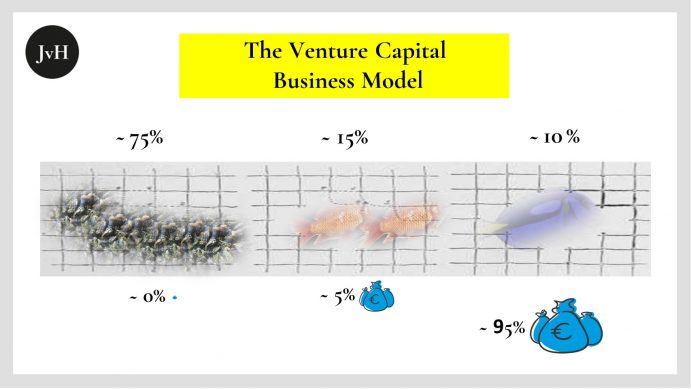

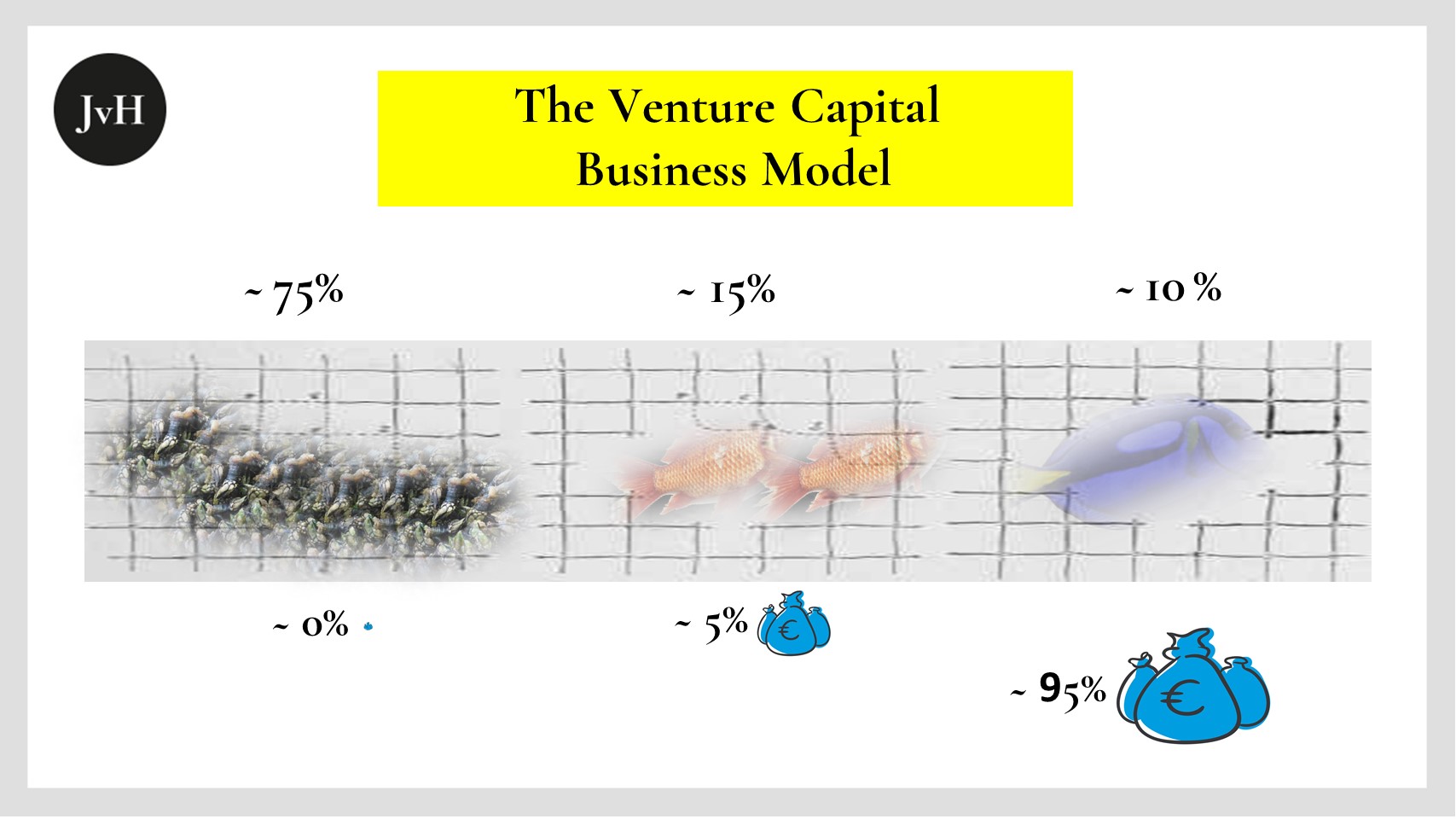

Virtually all venture capitalists agree that only a very tiny fraction of their targets accounts for the positive overall return of their funds, while most investments produce either no significant contribution or even result in complete losses, thus producing negative effects on fund returns. Depending on the individual fund, alternative target industries, investment stages, regional priorities, etc. the statistics vary, but the gist remains the same wherever we look: It’s Pareto, driven to an extreme.

Interestingly, the venture industry appears to not question this phenomenon at all. Why are venture capitalists so complacent when looking into the mirror? After all, Pareto does not tell us, that 20 % or an even lesser percentage of all investments need to account for 80% or more of a fund’s return. Pareto is no law of nature. I find this question relevant as we talk about an industry that specializes in what? Yes, business models.

There are a number of reasons that might explain this phenomenon:

- A prophet has no honor in his own country. This holds for smoking or drinking doctors, but also for venture capitalists who strangely and generally feel exempted from the standards they apply to their own target companies.

- To “blame” a law of nature for comparatively small returns is a handy support for GPs when discussing their performance with limited partners.

- When compared to other alternative investment industries, VC in recent years on the whole actually showed quite respectable results. So, why bother as long as fees and carry keep on flowing? Top quartile VCs according to Preqin average an IRR of 20%+. That might be a high benchmark within more liquid industries like mezzanine, buyout, distressed, or energy. But, despite being top quartile, it is fairly modest by absolute standards – equalling, e.g., an average multiplier of 6 over a period of ten years. So, comparing returns across different segments of the alternative investments industry is like comparing apples and oranges. It’s no good. But, again, it is of course quite helpful when it comes to nasty discussions with LPs.

- VCs, especially those engaged in consumer-focused industries are driven by the search for potential “unicorns”. Why do they do this? Because they need to compensate for bad investments. Why do they amass bad investments? Because they hunt for super returns. It’s a vicious circle. It is virtually impossible to anticipate positive outliers. So, take them all, particularly the bad ones 😉.

- Excellent start-ups tend to be managed by excellent founders. Frequently, these guys or girls are “better” than their respective counterparts on the fund side. So, the best start-ups rarely get locked in by merely good funds.

When VCs talk to founders, they always tell them: “Think big!” That’s perfectly okay in my view. But what does “Think big!” mean when we talk to VCs? I think it is a crass mistake to then think only about detecting potential unicorns.

What VCs should think about is to invest in the best teams. Period. The best teams are smart enough to make maximum use of their individual strength, ambitious enough to fully exploit market opportunities while remaining resilient in difficult times, learned enough to understand their own weaknesses, and flexible enough to cope with perilous threats. To invest in the best teams requires to be mentally and intellectually on the same wavelength. That’s why a16z, sequoia, etc. are positive outliers in the VC industry.