Am vergangenen Sonntag, dem 2. Advent, durfte man in „WELT am SONNTAG“ ein sehr spannendes und sehr langes Interview des Axel Springer Chefs Mathias Döpfner mit Elon Musk lesen, dem der Verlag gerade den „Axel Springer Award“ verliehen hatte. Neues schaffen: Großartig – Bestehendes verstehen: Langweilig Besonders interessant und auch gut fand ich Musks Antwort auf die Frage, warum er … Read More

Part 2: VCs Should Seek Flaws & Not Just Risks

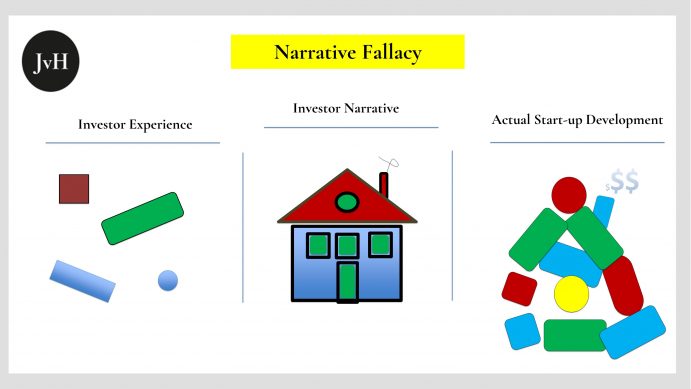

Since I hate to adorn myself with borrowed plumes, I’d like to point out that my and many other investors’ bias against “risk distribution” is rather old news. In his wonderfully anecdotal Zurich Axioms, dated 1972, Max Gunther, had already pointed out every relevant practical aspect pertaining to the topic. My issue today is a different one. I do not … Read More

Do VCs and Angels Sit in the Same Boat?

Part 1: “Diversification” From time to time people ask me whether investing selectively in start-ups as a “profession” is not quite an irresponsible gamble, especially if, like in my case, you have practically no other current sources of income. This question is meant rhetorically, because the people who ask and I, we know Kind Advisors Such rhetoric is usually followed … Read More

Was VCs und Business Angels verbindet – und was sie unterscheidet

Teil 1: „Diversifikation“ Hin und wieder werde ich gefragt, ob denn das selektive Investieren in Startups als „Beruf“, nicht ein unverantwortlich riskantes Vergnügen darstelle, insbesondere dann, wenn man, wie ich, über praktisch keine anderen laufenden Verdienstquellen verfüge. Dies ist eine rhetorische Frage, denn die Fragenden und der Befragte wissen beide a) dass dieses Risiko tatsächlich ziemlich hoch ist und b) … Read More

Rich Man’s Lottery (Part II) The Mystery of the Blind Hunt for Maximum Risk

Verdad Capital founder and (small cap) public equity crusader Dan Rasmussen recently published a report authored by his last summer Harvard intern Blake Patterson. The melody of the article matches Rasmussen’s bias towards public – and his highly critical attitude towards private equities as reported last week among other sources by the NY Times. So, is he right? In Venture … Read More

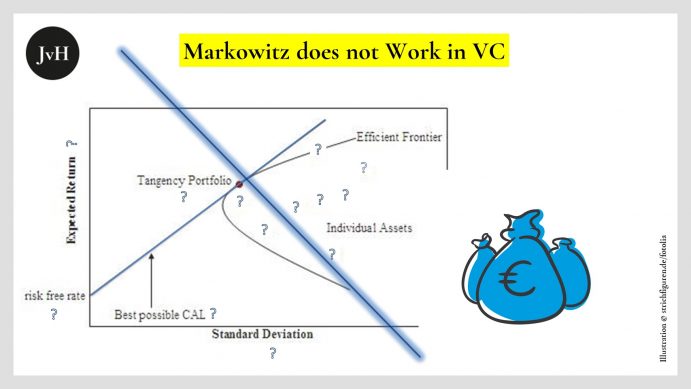

Risk Mitigation in the Venture Trade (Part 3): Markowitz does not Work

I guess (in the course of my two most recent blogs) I have made my basic stance clear that standard portfolio theory fails as far as start-up portfolios are concerned. Let us, just for the sake of the argument 😉, assume Markowitz’s paradigm could somehow be applied, or rather, transferred onto the start-up stage. What would it look like? I … Read More

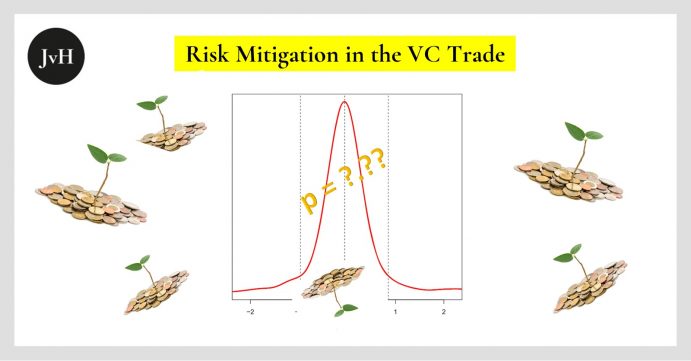

Risk Mitigation in the Venture Trade (Part 1)

Like in conventional asset management theory, the credo for the need of a “distribution of risk” or “risk diversification” is generally also considered to be inviolable in the venture business. In my opinion, the imperative is fairly nonsensical – at least when it is based on the number or the type of targets to be chosen. Within the asset class … Read More