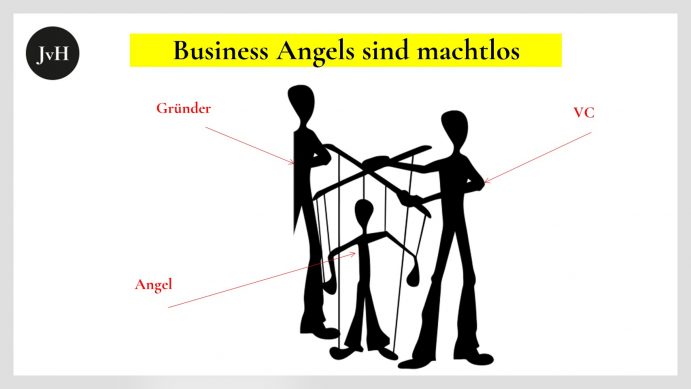

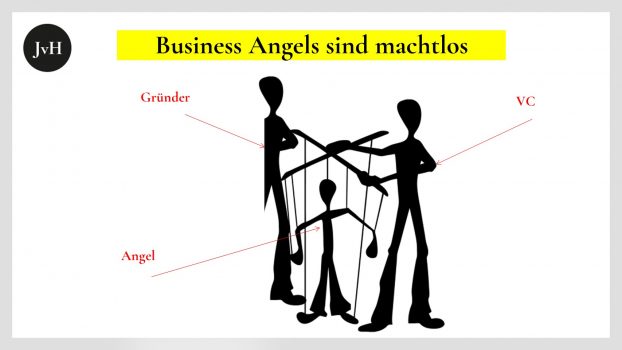

Marginal Participation Implies Marginal Influence

I have encountered a misconception among some angels, who actually believe their money entitled them to tell “their” start-ups how or where to go. Occasionally, business angels do get involved in the ongoing business processes of their start-ups. As a board member or as member of some advisory committee some angels actually may carry some weight and impact strategic, budget, exit decisions, etc. This is rare though and it is more likely that you encounter angels who want to engage themselves only to find out that their involvement is not really in particular demand. And even that occasional limited influence is very, very limited indeed, if you compare it to that of the founders themselves or that of their VCs. So much for “smart money”, which in most cases really is nothing else but a somewhat heartwarming flattery aimed at getting access to an angel’s “dumb cash”.

The reason for this is plain and obvious: angels’ stakes in start-ups very rarely reach a mark beyond 5% (per angel). So, even if all the angels pool their stakes, they very rarely arrive at a compound share exceeding, say, 20%. Exceptions of course always do exist.

Angels Need to Play Their Cards Wisely, if They Wish to Make a Diff

So, what does this tell us about “smart money”?

It tells us that the only way how smart money may actually play a role is by playing the angel card smart as well. She or he cannot do this by virtue of her or his shares. If the founders trust her or his competence, experience, business connections, the angel can exert influence by virtue of these qualities. So, should an angel want to influence her or his investment, she or he must be sure to be able to make a difference that is welcomed – be that an intellectual, network or experience related difference. The angel should take this into consideration when deciding where to invest. Target entities which do not require or demand angel impact, may very well be worthy targets. And targets which do require your advice might be worth your investment as well. So, it really is up to you, where to invest and in what capacity you wish to do that. Simply beware of start-ups that require your advice but do not seek it or that seek an advice you may not be able to provide.

If You Think You Can Do Better Than Your Founders, Then Set Up Your Own Start-Up.

The headline of the current and my two previous posts says: “Business Angel Mistakes”. The weak angel influence I am talking about here, evidently stretches the notion of “mistake”. It only turns into a mistake, if the respective angel believes her or his money bought influence. Yes, angel investors are being defined by the fact that, apart from cash, they may also provide advice, make relevant business introductions and point the fingers at potential risks and problems. But they are not being defined by having a right to do so and impose themselves on their targets. The illiquidity of their investments and their high-risk exposure is the price they have to pay for possible eventual returns that may infinitely excel current (European) interest rates. And, without wanting to sound Trumpian: If they think they can do better than their targets, who stops them from doing so?