Angels are all too willing to operate on level playing field with their target entities

This and my two subsequent posts in English shall be dealing with typical business angel mistakes. My “insight” originates from my own mistakes. To generalise by inferring from oneself is generally impermissible. Yet, I discussed the three issues with quite a number of other angels, who all came to similar conclusions. Should angels find that the following characteristics do not apply to them, all the better for them.

You Cannot Generalise on Start-ups…

To begin with: I know, business angels cannot be lumped together. It’s even less possible to generalise on business angel features than it is to do so with VCs properties. Due to VC interfaces with start-ups, LPs, the banking industry, competitors, angels, etc., VCs can’t help but standardize their general approach to some extent in an industry-wide manner. Angels have no need for such standardization, as long as they can gain access to quality start-ups.

… But that Does Not Protect Them from Criticism

Contrary to what it may seem at first glance though, this does not protect them from criticism. If there is no such thing as a typical angel, then one may not ascribe all the positive qualities that I repeatedly attributed to them in my recent posts either.

When we talk about angels in general, I mean the entrepreneurially experienced angel investor, the one who can either look back on his own founding and exit histories (best case) or who risked his own money as a managing partner in an earlier or still ongoing professional life. In short: I am referring to entrepreneurs with “skin in the game”, as NN Taleb calls them. Due to the fact, that they have come a long way to where they stand today and therefore cannot distance themselves from their own, very personal entrepreneurial history, such angels do display certain similarities.

Business angels who did not acquire their assets through their own efforts, i.e. professional successes and failures, do not fall under this category of “typical business angel”. Such angels are more similar to the phenotype of Multi Family Office and resemble VCs rather than angels. Such angels also deserve praise and criticism. But in my posts, I am not dealing with them.

Business Angels Decide Prematurely

I had previously argued, that business angels were more hesitant with spending their money than VCs, because it was their own money. Despite that, angels tend to decide too hastily. Once convinced of a funder team, they remain convinced and are usually unwilling to be dissuaded. If an angel has mentally committed him- or herself, then he or she will stick to this decision, both before the money is spent and afterwards as well. “Afterwards?” Sure. For angels are usually more prepared to keep their failing start-ups afloat by investing further cash, than let their ship sink.

Angels Generally Lack Professional Distance

Unlike the average VC, business angels usually rely on their “nose” and let their “experience” speak for itself. They tend to consider themselves the best in their field and very often lack the professional distance from their target entities.

Once “evangelized”, they remain adamant to have taken the right decision, they nourish their biases and remain resistant to any contrarian reason. To them, such reason will assume the quality of “fake news”. That’s why angels hate to engage in due diligence. Of course, they know that they should do their job. That’s why they are so happy to let VCs do the dirty job and co-invest once it’s done. The problem here is that a negative VC decision is not necessarily a plausible reason for an angel to abstain from an investment…

Angels Should Want to Keep Their Targets at Distance

So, what can our angel do to arrive at a somewhat sound decision as to whether to invest? Strictly speaking, not much at all: It is impossible to anticipate with some decent degree of probability the future path of even the best start-ups. It may be possible to reconstrue that future, once it is there, but even that reconstruction need not be accurate. Mind you: It is not the wealth of data that is missing beforehand. It is the sheer impossibility to predict the future on the grounds of the present and the past. And, start-ups have no history worth mentioning, anyway. Plus: Remember? The strongest start-ups often also have the biggest weaknesses.

In short: Irrespective of how much data we might possess, we still do not know how to weigh and interpret them accurately. Only the future will tell. This evidently applies to both, angels and VCs. The difference between the two simply is, that VCs will pretend to know more about potential crises and risks and thus be more reluctant to be as euphoric about their potential targets as angels tend to be.

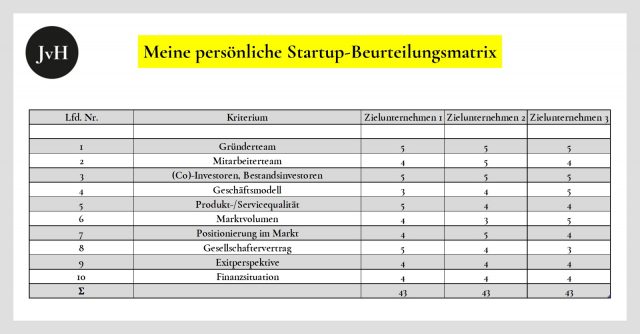

The only thing you can do as an angel is to critically question yourself as meticulously as you can and check your own assessment once, twice, or even thrice. I myself compiled a catalogue of 10 criteria on the basis of which I assess by targets on a scale of 1 point (minimum) to 5 points (maximum). A cumulative minimum score of 40 and an underperformance “grade” of less than 3 points in one out of the ten criteria max. is my “golden” rule.

This rule is supposed to function as a regulative principle, as a controlling tool and is not meant to have any predictive quality as to how well a target entity will actually perform. And yes, I have to admit: I also have that tendency to give better marks to the entities I like than to those I may not like all that much. One needs to be wary of this tendency and try to avoid betraying or manipulating oneself.

Gary A. Klein’s “Pre Mortem Analysis”

Another helpful exercise is to engage in brainstorming sessions on the conditions under which a business case will surely fail. The American experimental psychologist Gary A. Klein calls his wonderful instrument the “Pre Mortem Analysis”. This exercise can also be done in a joint effort with the start-up team in question. It will show if the team actually considered realistic base and worst-case scenarios and to what extent the founders’ vision resonates with that of their team members.

In my next post, following on from what has been said here, I will deal with the structural disadvantage that angels, unfortunately, possess as human individuals if you compare them, again, to VCs or corporates.