Part 1: “Diversification” From time to time people ask me whether investing selectively in start-ups as a “profession” is not quite an irresponsible gamble, especially if, like in my case, you have practically no other current sources of income. This question is meant rhetorically, because the people who ask and I, we know Kind Advisors Such rhetoric is usually followed … Read More

Stairway to Corporate Heaven?

On Ray Dalio’s Principles (Part II) Last week I stated that a general master plan for individual or business success, as outlined in Ray Dalio’s #Principles, is a good thing – in principle 😉. Provided the plan makes sense, it’s good because it serves as a useful heuristic to make sure I’m on course. The disadvantage of such a general … Read More

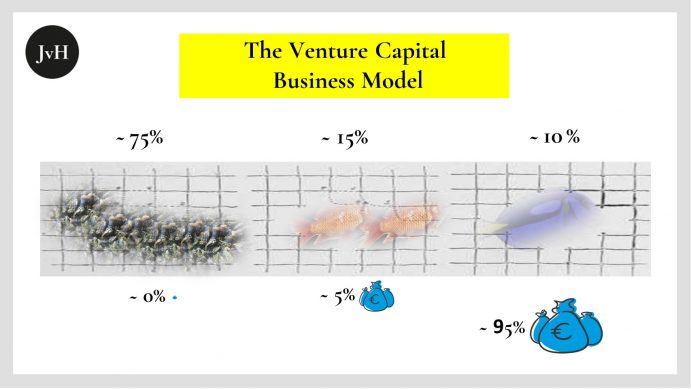

The VC Business Model: Pareto Driven to Extremes

Virtually all venture capitalists agree that only a very tiny fraction of their targets accounts for the positive overall return of their funds, while most investments produce either no significant contribution or even result in complete losses, thus producing negative effects on fund returns. Depending on the individual fund, alternative target industries, investment stages, regional priorities, etc. the statistics vary, … Read More