The Team is Key, Nothing else is

The central date for Angels in assessing early-stage start-ups is their founder teams. Evidently, a very good start-up will present a very good business model, a promising market, an excellent product or service and so on. It goes without saying that a good founding team will have developed such a sound business model, discovered a promising market and developed promising MVPs at the time they meet their angels for the first time. But we all know that early-stage start-ups are likely to be changing their business model a number of times, fine-tune their products or services, modify their market focuses and adapt their team structure and capital requirements accordingly. Therefore, it simply makes no sense for seed investors to focus on aspects other than the qualities of the founding team. The key to success is not the design of the future company. The key is the capability to carry through “agile” testing of viable alternatives, realize when a market ceases to be promising, swiftly arrive at the most promising alternative products and/or markets and implement and enforce these alternatives, if necessary, against internal and external stakeholder resistance.

No AI can Anticipate Start-up -Team Qualities

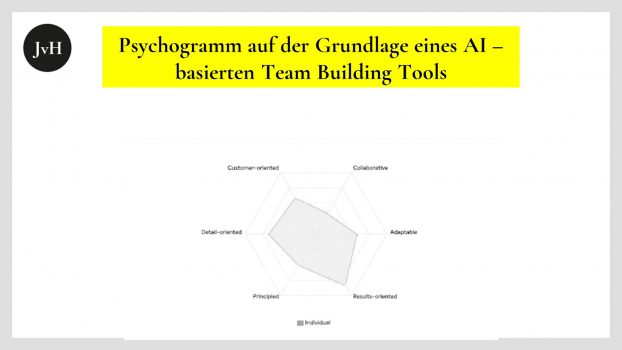

Unfortunately, this very criterion, the quality of a founder team, cannot be measured reliably at all. Sure, there is a host of handy, AI-assisted tools to assess team qualities in qualitative and quantitative ways. Yet, none of these methods, even if they merrily claim the opposite, is capable to balance out or accurately weigh significant weaknesses in a founding team vis à vis potentially even more significant strengths. “Significant” equals leading to economic success. It will depend on the circumstances the start-up in question may encounter in the course of its progress which strengths and which weaknesses will one day turn out to be significant. And what these will be is not just a question of internal or external circumstances. It is the result of a dynamic interplay of both internal and external circumstances – the latter being unpredictable as a matter of principle.

Analytical, Courageous, Flexible, Prudent, Resilient, Risk-oriented, blah, blah, blah,..

Next problem: We have all heard about desirable founder properties: courage, flexibility, intelligence, integrity, leadership, resilience, etc. All these features are certainly important. Yet, put forward in this general fashion, they do not help us, really. Take resilience: Given a situation that requires wise restraint or flexibility, resilience may manifest itself as intransigent stubbornness with lethal consequences. Conversely, an analytically circumspect founder may simply be blown to pieces because he or she was not sufficiently daring “to go for it” at the right time, fighting for a pole position before others with less circumspection, analytical insight but more money, energy and daring may have done so. Analytical skills may lead to a founder’s inability to take timely decisions. Leadership and motivational potency by no means grant success, for charisma could turn out to be a highway to hell. One could also argue that the many desirable, but evidently heterogeneous founder features neutralized each other: the “right” mix of all these and many other important leadership properties would look like a static parallelogram of mutually neutralizing forces leading nowhere.

So, we arrive at what I have said already in the previous section: We will only learn in hindsight which of these very sought-after properties is really key for a particular start-up. No human or artificial intelligence can predict this with any degree of reliability. Moreover, Marc Andreessen is right in his observation that the “particularly strong” start-ups are also those with particularly pronounced weaknesses.

Sadly, there are no other Criteria

Nevertheless, business angels are well advised to make their investment decisions largely dependent on the observed strengths and weaknesses of the founding teams. As stated at the beginning, there simply are no other criteria. The quality of the MVP, the choice of the business model, the market, the team etc. may say little about the impact and benefit they might carry in the future. But they say a lot about the quality of the founder team now. And that’s all we have.

Angel Sympathy is no Indication for Start-up Success either…

In the absence of hard criteria for start-up assessments, angel investors have a tendency to apply their personal sympathy for a founding team instead. The “chemistry” between an angel investor and the founders may indeed be of some value, but it is not essential. The prerequisite for start-up success is certainly not that its founders are being liked by their business angel/s.

VCs do not run the risk of confusing personal sympathy with the prerequisites for success. VCs are personally less involved. In VCs there is not just one contact person dealing with a start-up. There are other stakeholders: colleagues, superiors, partners and, above all, LPs who don’t care about a colleague’s personal preferences. They simply expect a good return and want the rope to be pulled if it is foreseeable that an investment will turn into a flop.

… But one’s Own CV May Very Well Serve as a Foil for Evaluation Proper

On the other hand, a business angel is very well advised to use his own professional biography and that of his former colleagues, employees and superiors to assess e.g. how likely it would be that a dicey situation x for a certain founding team will lead either to a successful end y or a threatening situation z depending on whether the team takes alternative decisions a, b or c. By the way: an angel’s own mistakes and defeats are a much better and more reliable gauge to assess a start-up than his or her past victories.

Keep your Distance to Enjoy a Bird’s Eyes’ View

The best remedy against too close a relationship between angels and start-ups is to keep the start-up founders deliberately at a “safe” distance. This is by no means easy, if you like your founders and their teams as you usually do. I am not suggesting that you should not be eager to help and assist wherever you can. After all, that’s the idea behind “smart money” (a somewhat overrated angel dimension though, and often just a politely wrapped compliment aimed at getting at an angel’s “dumb” money). But somewhat “aged” Angels like myself love to perceive themselves as young, cool and dynamic and get simply too close to them in the process. And that is a danger. If an angel investor has to make tough investment decisions which, as we have seen above, depend almost entirely on his or her assessment of soft human factors, then this angel should not increase his or her risk any further, by willingly allowing him- or herself to be directed into a family-like setting that makes an objective and independent decision even more difficult…