Like in conventional asset management theory, the credo for the need of a “distribution of risk” or “risk diversification” is generally also considered to be inviolable in the venture business. In my opinion, the imperative is fairly nonsensical – at least when it is based on the number or the type of targets to be chosen. Within the asset class … Read More

Wrong Tests and Ill Fitting KPIs Should not be Held Against A/B Testing

This time @AndrewChen ’s Newsletter was somewhat weird. Under the heading “Conservation of Intent: The hidden reason why A/B tests aren’t as effective as they look, Andrew argues that measures which result from A/B testing and aim at improving conversion rates do not take into account that normal users among those who churn are statistically dominated by “low intent” minnows, … Read More

Merkel on German IIoT – Why Germany is on a Dangerous Path

I think Germany is lucky to have a physicist with some respectable track record as head of government. She is intrinsically motivated to push the country’s sadly lagging digital transformation and she does not like empty blab. Despite that she needs to tread very carefully. One “wrong” word might result in disastrous political or industrial effects. In last Friday’s first … Read More

On Quality and Quantity in Start-up Processes

The issue how to quantify quality is an old one. In antediluvian times it used to be a common place that you cannot e.g. map quality on straight lines, because quality is a multi-dimensional category whereas quantity is one-dimensional. In business such philosophical qualms are generally perceived as academic and irrelevant: In HR and marketing for instance, where the “quality” … Read More

“Sharing is Caring”? Why Rifkin is Wrong

In his much-acclaimed book The Zero Marginal Cost Society, The Internet of Things, the Collaborative Commons and the Eclipse of Capitalism, palgrave mcmillan 2014, Jeremy Rifkin declares the internet economy and its key ambassadors the millennials to have dethroned capitalism for the sake of the new “World Wide Web” – inspired economic model. According to Rifkin, “openness”, “universal access for … Read More

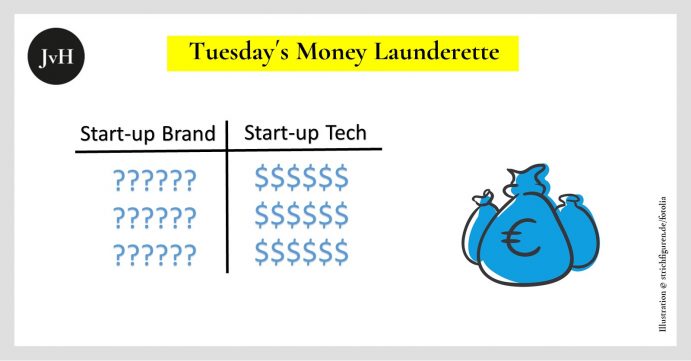

Smart Tech VCs do not Invest in Brands

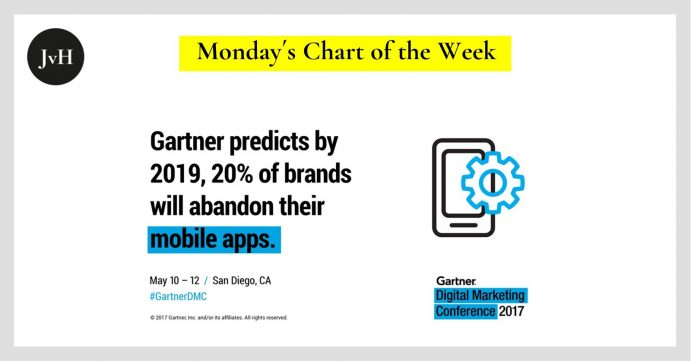

There are times when you really wonder… Four days ago, I read an article on hackernoon.com on “The Value of a Brand for Tech Companies” by Cameron McLain, principal at Hummingbird Ventures. The gist of this article is that tech start-ups and VCs alike should embrace the idea, that brands constitute an important value for tech start-ups worth of being … Read More

Tech-Revolution IIoT?

Being a historian of science by education, it amazes me to find most of my contemporaries in the venture business so at ease with detecting with an abundance of certainty “next big things”. How they manage to identify “tech revolutions” within their immediate vicinity or forecast the lives of the generation to come remains a mystery to me. I wish … Read More

ICO Instead of Series A?

Emitting publicly listed shares instead of diluting ownership by a series A financing round sounds like a very tempting way for founders to get going at early stages: Instead of having to “prove” their company’s worth to notoriously skeptical VCs and angels, they would simply have to pimp their equity story and promise things that need not come to fruition. … Read More

Prognostic Fallacies

My most recent blog post dealt with fake problems (and corresponding fake solutions). Today I want to direct my “spotlight” (kindly notice a dose of self-irony here) at fake reasoning and fake explanations. In today’s newsletter “Pioneers’ Breakfast” by the excellent German special interest magazine t3n the reader is invited to read an article on the allegedly inexorable surge of … Read More

Startups Fake Problems Revisited

My post on Monday raised the contention that many pitch decks invent or magnify problems in order to make their “solutions” appear more impressive. I also stated this was an issue particularly pertaining to Germany and less so to start-ups in America, China, France, or the UK. My third claim was that over there, investors operate on more solid empirical … Read More